🙊 Bored Ape’s Floor Price Seesaws as Investors Claim New Coin

Hello Defiers! Here’s your belated, bonus newsletter from Friday. Don’t blame us for the tardiness — blame the Ape coin! When we ran our lead story on Friday about APE’s insane debut it broke our site! Everything’s fixed now… 😁

News

DeFi Primer

Podcast

🎙Listen to the exclusive interview with Fabian Vogelsteller here:

Video

Links

Punk6529 on the Significance of Bored Ape Yacht Club and CryptoPunks: Unchained

Stop the AAVE Migration and recover 4% of the AAVE supply: Aave

@terra_bots_io Lottery Pool is Live on @pylon_protocol Gateway: Terra Daily

Trending in The Defiant

Ukraine

Do you want to make a real difference in the Ukraine crisis? Until March 24th, if you donate to help improve the situation in Ukraine on Gitcoin your funds will be matched by a pool of over $700,000 using the power of quadratic funding.

In some cases, 1 DAI can be matched up to 50x, so even small amounts are meaningful. Peace is a global public good, and it's become increasingly clear that we have to work to collectively maintain it. For more details, check out http://gitcoin.co/grants and go to the "Support for Ukraine" category.

Public goods are good.

Gitcoin grants sustain web3 projects with quadratic funding

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Verse Network by STP, is a Layer 2 for DAOs. Redefining value one DAO at a time.

Eden Rocket RPC, providing the fastest private transactions on Ethereum (90%+ hashrate). Trade better anywhere on Ethereum with Eden Rocket RPC.

Zerion is Mission Control for Web3: an intuitive DeFi portfolio manager, multichain tracking & trading and the best place to show off your NFT collection.

Unstoppable Domains, Unstoppable Domain is the #1 provider of NFT domains. One domain, the entire metaverse - your Unstoppable domain is all you need to verify your humanity and access sites and apps on the decentralized web. Get yours today!

NFT Coins

🙊 Bored Ape’s Floor Price Seesaws as Investors Claim New Coin

APE's Debut Anything But Dull as Investors Buy NFTs

By Owen Fernau

DEBUT Maybe it was a surprise, maybe it wasn’t. Whatever. The Bored Ape Yacht Club now has a token. The ticker? APE, of course. And its debut was anything but boring.

WHIPSAWED No sooner did the token hit the tape on Thursday morning than heavy price action whipsawed one of the NFT world’s most popular collections. Holders of Bored Ape NFTs, as well as Mutant Ape Yacht Club (MAYC), are entitled to claim APE tokens. So after it was released, the BAYC floor price spiked to 106 ETH from 92 ETH, a 13.2% jump, as buyers piled into NFTs.

PROFITS By 1 PM New York time, the BAYC floor price had dropped by a quarter, to 79.5 ETH before stabilizing at 89 ETH, according to CoinGecko data. As for APE, it’s sporting a whopping $746M market cap on its opening day. But the token is down 22% from its open, probably because investors are rapidly flipping it to pocket profits.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DAO Governance

🌪 A Radical Proposal to Revive MakerDAO Roils Community

Project Considers Tapping Real World Assets and Equity Offer

By Samuel Haig

LIQUIDATIONS MakerDAO, the trailblazing DeFi lending and savings project, has reached a crossroads. Its token, MKR, is languishing. Rivals are challenging its position as the go-to decentralized stablecoin provider. And more worrisome, its dwindling surplus fund is raising fears that the platform might suffer heavy liquidations in a long bear market.

RADICAL MOVES But help is on the way, maybe. On March 17, Hexonaut, a protocol engineer at MakerDAO, joined forces with colleagues and submitted a new governance proposal called “Aggressive Growth Strategy.” It’s urging Maker’s membership to consider a bevy of radical moves to rejuvenate the popular DeFi project, including tapping real world assets to shore up its surplus fund. The authors estimate that move will generate an additional $20M to $40M in annual revenues.

BEDROCK It’s striking to see that MakerDAO, a s considering cozying up to TradFi to stabilize its financial bedrock. The project remains a steadfast and sizable force in decentralzied finance, with a market cap of $1.8B and total value locked of $16B, according to DeFiLlama. But Hexonaut and the engineer’s fellow authors say the problem has become acute.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Market Action

📈 Ether Bulls Ascendant as Anticipation Builds for The Merge

By Samuel Haig

BULLISH After a bearish start to 2022, Ethereum market sentiment appears to be flipping bullish.

RALLY The first quarter has been rough for Ethereum and DeFi, with ETH shedding a quarter of its value and the combined capitalization of DeFi assets falling 22%. The downturn prompted many analysts to declare the bull trend over, but Ether now appears poised to rally ahead of its highly anticipated Eth2 chain merge.

TESTNET On March 15, The Merge was successfully completed on the Kiln merge testnet, marking the final test of the chain merge before it is deployed to public testnets. Analysts took to Twitter to remind the community what can be expected when the Ethereum mainnet merges with the Eth2 Beacon Chain, forecasting a 90% reduction in Ether issuance and a more than 99% drop in energy consumption.

THE MERGE The progress towards The Merge appears to be reflected by Ether’s recent bounce, with ETH gaining 14.4% since March 14. And institutions loading up their ETH bags.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Primers

🧐 What is Compound?

Learn About A Leading Crypto Lender in This DeFi Guide

Kurt Ivy walks you through the basics.

TL;DR At the most basic level, Compound is an autonomous protocol that calculates interest rates using algorithms. It is permissionless, meaning anyone can access the tools provided at any time. There is no verification process and no user identification mechanism. This real-time interest rate calculation can be used for a variety of financial applications.

INTEREST For individuals, Compound is primarily used as a cryptocurrency borrowing and lending protocol. Users can deposit one of the supported tokens into a shared pool at any time and receive interest. Or, after depositing their tokens, they can borrow a smaller amount of tokens and pay interest. The amount of interest is determined by the supply and demand of tokens deposited and borrowed in the pool.

LIQUIDITY To lend with this protocol, all you need to do is supply the cryptocurrency that you want to provide liquidity for. Lenders deposit tokens into a liquid fund. Once you do that, you will immediately start earning interest, which is controlled by the supply and demand of the currency.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

Lithium Finance is the first collective-intelligence pricing oracle that provides precise and timely pricing information on private and illiquid assets. Our protocol leverages crowd wisdom and proprietary mechanisms to provide pricing on private and illiquid assets.

Unlike most blockchain oracles that source data from 3rd party providers, the Lithium Oracle is the only on-chain protocol that generates first-party pricing for illiquid assets across a broad spectrum that includes digital games, crypto tokens, and more. Lithium’s use-case spans protocols in the DeFi, NFT, and traditional investing space (e.g., Hedge funds/Private Equity).

Learn more about at www.lith.finance

The Tube

📺 The Defiant Weekly: Why do gamers hate NFT's? Part 2!

📺 Real World vs. The Defiant: RATE HIKES, A PRESIDENTIAL PASS AND YUGA LABS FLEXING...

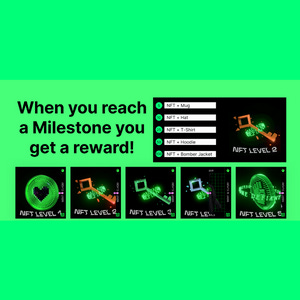

The Defiant - Referral - The Defiant

Enter your email to unlock your referral link. Help your friends keep up to date with the latest DeFi News and win rewards.

Links

🔗 Punk6529 on the Significance of Bored Ape Yacht Club and CryptoPunks: Unchained

In his first podcast appearance ever, Punk6529, known for writing massive threads on Crypto Twitter, discusses the cultural and historical significance of Bored Ape Yacht Club creator Yuga Labs purchasing the intellectual property rights to CryptoPunks and Meebits from Larva Labs.

🔗 Stop the AAVE Migration and recover 4% of the AAVE supply: Aave

As indicated in this snapshot vote 5 the community has already decided to put an end to the LEND → AAVE migration process.

🔗 Solidity 0.8.13 Release Announcement: Solidity Blog

Solidity v0.8.13 fixes an important bug related to abi.encodeCall, extends the using for directive and implements “go to definition” for the language server.

Trending in The Defiant

Bored Ape’s Floor Price Seesaws as Investors Claim New Coin Maybe it was a surprise, maybe it wasn’t. Whatever. The Bored Ape Yacht Club now has a token. The ticker? APE, of course. And its debut was anything but boring.

A Radical Proposal to Revive MakerDAO Roils Community MakerDAO, the trailblazing DeFi lending and savings project, has reached a crossroads.

Aave Launches Souped Up V3 on Fantom and Avalanche Aave, DeFi’s largest money market by cross-chain TVL, has launched its new v3 protocol across six different networks. The upgrade promises faster load times and lower gas costs.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)