😳 Black Pilled at Bitcoin 2022: Do We Know What All This Is For?

Hello Defiers! Here’s what we’re covering today:

News

Opinion

Research

DeFi Guides

Podcast

🎙Listen to this week’s podcast episode with Espresso Systems’ Jill Gunter:

Video

Elsewhere

Binance embarrassed after unveiling swastika-like emoji on Hitler’s birthday: CoinTelegraph

Near-Based DeFi Protocol Bastion to Launch BSTN Token at a $180M Valuation: CoinDesk

FIP-55: Shifting resources away from the Convex AMO: Mechanism Capital

Aave Grants is excited to be sponsoring #HackMoney2022: Aave Grants DAO

Trending on The Defiant

Moonbirds Shatter OpenSea Records With $240M Traded In Four Days

Yearn Creator Andre Cronje Slams Crypto Culture, Pivots To ‘Regulated Crypto’

Index Coop’s New NFT Index Fund Includes Blue Chips Like CryptoPunks and Bored Apes

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

SynFutures is a DeFi derivatives exchange that enables permissionless futures trading, allowing anyone to list and trade any asset with a price feed. Learn more!

Nexo is a wallet where you can easily exchange between 300+ unique market pairs, receive up to 0.5% cashback or get instant liquidity against your crypto assets with flexible credit lines. Get started!

Sperax has created $USDs, the stablecoin that generates passive income for holders. Thanks to the Auto-Yield feature, it pays to hold $USDs. Try it yourself here!

APWine is a pioneering yield tokenisation protocol, allowing users to get their future yield in advance. Hedge your risk on APY volatility or speculate on yield with their native AMM.

DeFi Incentives

💰 Aave V3 Depositors Can Pocket Avalanche Token Rewards

AVAX Incentives Show Rewards Still Key to Liquidity

By Owen Fernau

FLUX Token rewards for in-app deposits are in a state of flux. DeFi 2.0 was expected to provide an alternative for paying out tokens in exchange for deposits. Compound Finance may cut rewards. In other parts of DeFi, the money is still flowing.

AVALANCHE Case in point: Luigi D’Onorio DeMeo, head of DeFi at the Ava Labs, announced on April 20 that AVAX token incentives will be available for depositors in Aave’s V3. AVAX is the native token of the Avalanche blockchain network.

LAUNCH Ava Labs is the primary company developing the Avalanche blockchain’s ecosystem. Lending protocol Aave launched its V3 last month on both Avalanche and Fantom. Patrick Sutton, vice president of PR and communications at Ava Labs, told The Defiant that the AVAX rewards were part of Avalanche Rush, a $180M incentive program launched last August.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Merge

🚀 Lido’s Share in Ethereum Staking Hits 90% as The Merge Approaches

By Samuel Haig

DOMINANCE Lido’s dominance over Ethereum staking continues to grow. According to data from Dune Analytics, Lido, a liquid staking provider, is the single-largest Ethereum staking service with almost 29% of all Ether staked on the Eth2 Beacon Chain. The protocol sports 90% dominance over the liquid staking sector. The second-largest staking provider is centralized exchange Kraken with 8.75%, followed by Staked.us with 3.35%.

HODLERS The Ethereum team launched the Beacon Chain in December 2020, paving the way for the network’s transition to Proof of Stake and enabling hodlers to stake their Ether for the very first time.

UPGRADES But stakers are unable to withdraw their funds until future upgrades have been completed after Ethereum’s highly anticipated chain-merge dubbed The Merge. It is slated to go live during the third quarter of this year. The long-standing lack of withdrawal functionality has facilitated the emergence of liquid staking providers.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

NFT Marketplaces

🖼 Coinbase Launches NFT Marketplace Beta

By Jason Levin

FEED Crypto exchange Coinbase has opened the beta version of its NFT marketplace to a waitlist of 3 million users. Launched on Apr. 20, Coinbase’s NFT platform has already been likened to a web3 Instagram as users can make profiles, follow accounts, browse a “For You” feed, and comment on NFTs.

DROPS In a blog post, Coinbase wrote that in the coming weeks, it’s “planning to add drops, minting, token-gated communities, and the option to buy NFTs with your Coinbase account or a credit card.” In addition, the platform will add support for NFTs on multiple chains and “intends to decentralize more features by moving them from Coinbase tech to decentralized solutions.”

COMMUNITY In a press briefing Tuesday, Coinbase’s vice president of product Sanchan Saxena said, “This product is more than just buying and selling, it is about building your community. It is about making sure that you can connect and engage with them on the platform. […] It’s a very social marketplace.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Opinion Feature

😳 Black Pilled at Bitcoin 2022: Do We Know What All This Is For?

Soul Searching Amid the Glitz and Glamour

In which Bailey Reutzel wanders the wilderness of excess at Bitcoin 2022 and comes back with some hard truths…

BULL As I’m watching men struggle on the mechanical bull (thinking, shouldn’t they only be using one hand?) at Bitcoin 2022 in Miami last week, a thought from the deep recesses of my mind emerges: What is all this for? A documentarian who has been patiently listening to another one of my cynical rants echoes my thoughts and asks: “So why are you still here?”

PRINCIPLES And I have to admit that, well, I haven’t really thought about that in awhile. And then I also have to admit, that the reason why I haven’t been thinking about whether all this aligns with my principles and goals, is probably that, well, the money’s good here.

GRIFTER Blink. Blink. Blink. Ohhhhh shiiiiit. Am I a grifter?!

CONTENT Let’s get a few things out of the way: This piece really isn’t about chiding Bitcoin Magazine’s conference (like I did last year). All that BS still remains, but it has taken a bit of a backseat. It isn’t about that ugly-ass eunuch bull or the confusion of telling your attendees to never sell while also hurraying innovations meant to make bitcoin the payment method for your morning coffee or evening beer. This isn’t about any of the actual content.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Research

⚙️ IOSG Report: A New Financial System Will Be Built on Rollups

A Deep Dive Into What Comes Next for DeFi

TL;DR

After five years of expansion, the DeFi market is largely consolidating around the winners in each sector.

With the lack of new primitives, multichain DeFi became the main narrative with most chains replicating the Ethereum DeFi map.

While the multichain narrative combined with saturated Ethereum led to increased activity on other chains, large capital holders have shown a strong preference for safety. The largest Ethereum protocol Curve.fi alone still has more TVL than the aggregated TVL of all the apps built on top of Avalanche and Solana

On the other hand, more scalable chains led to the inclusion of user groups priced out of Ethereum. However, the contribution of such users to the general on-chain activity is rather marginal.

Nevertheless, it is clear that none of the monolithic blockchains in their current forms are able to support the global adoption of DeFi.

In the long term, we expect most applications to be built on top of rollups which are the only solutions that could eventually support billions of users in an economically sustainable way without sacrificing fundamental principles such as decentralization, censorship resistance, security, and trustlessness.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Primers

🦊 How to Transfer Crypto from Robinhood to MetaMask

A Step-by-Step Guide for Ethereum Wallet Users

By Arya Ghobadi

FEATURES Robinhood is a trading app that lets investors buy and sell stocks, options, exchange-traded funds and cryptocurrencies without paying commissions. With most online brokers now offering zero-commission trading, Robinhood is adding new features. This includes a recurring investment function that lets investors set up scheduled trades.

WAITLIST Robinhood offers both web and mobile trading. The platform has periodically suffered outages and imposed trading restrictions during volatile market cycles. On April 7, Robinhood released a cryptocurrency wallet for “all eligible waitlist members”. This means some 2 million users who were waiting for access now can use Robinhood’s wallet offerings. In this tutorial, we will show you how to transfer your cryptocurrencies from Robinhood to MetaMask.

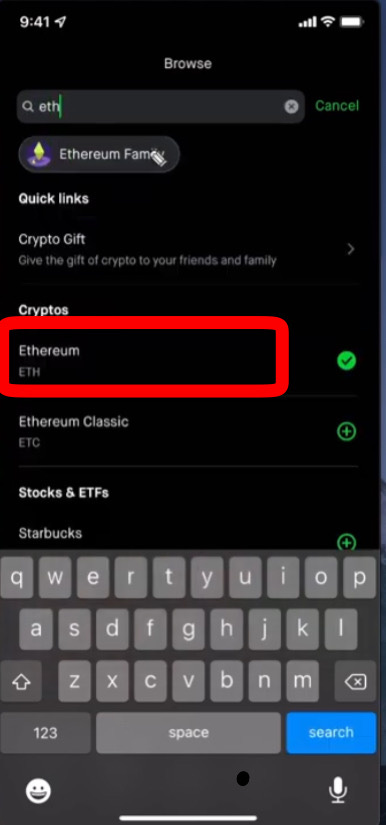

SEARCH Open your Robinhood account and click on the search button: Search for the crypto that you are going to send to your MetaMask and select it. In this tutorial we use Ethereum:

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

dYdX Grants: Powering the Future of dYdX With Community Grants

dYdX is the leading decentralized exchange offering perpetual trading across multiple assets. Users can trade seamlessly with low fees, deep liquidity and 20x buying power through instant transactions supported on Layer 2. We are on a mission to build the world’s leading crypto trading platform, and are now powering this goal with community-driven grants.

The dYdX Grants Program launched in 2022 to source and promote open source contributors building on top of the dYdX Protocol. The program has already funded over 50 grants with +$2M in pledged DYDX. Grants are focused on building new tools, marketing campaigns, analytics, educational content and so much more.

Calling all builders, traders, and community members to apply for Grants! Apply here!

The Tube

📺 Hot Stuff: Red Hot DeFi Opportunity | 67% APY on Mars Protocol

Job Board

😆 The Meme Studio: Meme Artist / Shitposter / Illustrator / Designer / Artist

We are a fast growing crypto content agency focused on memes, animation and art. We have a large need for meme makers and illustrators who understand various internet sub-cultures especially useful if you have been or participated in the following:

- /biz/ on 4chan

- DeFi degen meme culture across Telegram & Twitter

- NFT/P2E/DeFi culture in Discords esp. meme channels

For more info, click here.

Elsewhere

🔗 Binance embarrassed after unveiling swastika-like emoji on Hitler’s birthday: CoinTelegraph

Binance, the world’s largest cryptocurrency exchange, released a new Binance Emoji on Twitter that users noticed bore a striking resemblance to a swastika.

🔗 Near-Based DeFi Protocol Bastion to Launch BSTN Token at a $180M Valuation: CoinDesk

Near’s largest decentralized finance (DeFi) protocol, Bastion, is launching its own token in a sign of the continued rapid development of the Near ecosystem.

🔗 FIP-55: Shifting resources away from the Convex AMO: Mechanism Capital

Pause the de-collateralization strategy of minting FRAX into the FRAX3CRV pool in the Convex AMO. Instantiate an FXS TWAMM AMO to increase FXS buy pressure through seigniorage and burn. Deprecate buyback and re-collateralize for the v1 mechanism.

Trending on The Defiant

Moonbirds Shatter OpenSea Records With $240M Traded In Four Days Trading volume on NFT marketplace OpenSea hasn’t been this high since January. That’s thanks to Moonbirds, a collection of 10,000 owl avatars that launched on Apr. 16.

Yearn Creator Andre Cronje Slams Crypto Culture, Pivots To ‘Regulated Crypto’ Andre Cronje, the DeFi developer behind Yearn Finance and several other unregulated financial protocols, has voiced his disdain for crypto’s culture of egotism and greed, and remodeled himself as a pioneer of regulated crypto.

Index Coop’s New NFT Index Fund Includes Blue Chips Like CryptoPunks and Bored Apes When day traders grew tired of sleepless nights day trading Tesla stock, they turned to index funds: passive investment vehicles that exposed them to huge swathes of the market at once.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Samuel Haig, DeFiDad, and yyctrader, and edited by Edward Robinson, yyctrader, and Camila Russo. Videos are produced by Robin Schmidt, Alp Gasimov and Daniel Flynn. Podcast is led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Signest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr)