⚔️ Avalanche Attorney Accused Of Using Lawsuits To Kneecap Rivals

Hello Defiers! Here’s what we’re covering today:

News

GameFi

Markets

👀 Defiant Premium Story for Paid Subscribers (📜Scroll to the end!)

Podcast

🎙Listen to the exclusive interview with Jake Chervinsky in this week’s podcast episode:

The Tube

DeFi Explainer

Elsewhere

Grayscale, Disclosing SEC Queries, Says Cryptos XLM, ZEC, ZEN May be Securities: CoinDesk

The Merge is coming: UPGRADE YOUR CLIENTS!: Ethereum Foundation

Trending in The Defiant

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Nexo’s fundamentals-first model helps you secure your assets and grow your wealth. The company now provides an increased insurance on custodial assets of $775 million. Learn More!

Zetachain is the first public L1 blockchain that natively connects with any chain and layer including Bitcoin and Dogecoin without wrapping or bridging assets. Dive into the docs to start building the future of multichain.

Bring your NFT product to market in hours with NFTPort's APIs. Mint NFTs as scale, deploy fully owned contracts & access high quality NFT data - all with simple REST APIs every developer knows. It's time to build.

Join Klaytn’s global flagship hackathon and hack your way to over US$1 million in prizes, grant funding, and incubation opportunities. Register now

DeFi Disputes

⚔️ Avalanche Attorney Accused Of Using Lawsuits To Kneecap Rivals

AVAX Has Fallen 15% Since Friday

LAWSUITS In a series of brief, undercover videos published on a little-known website Friday, lawyer Kyle Roche bragged of his close ties to the founder of the Avalanche blockchain and seemed to suggest he had filed frivolous lawsuits in a bid to weaken its competitors.

DROPPING Avalanche’s native token, AVAX, has fared worse than other major cryptocurrencies over the weekend, dropping more than 15% since Friday, according to data from The Defiant Terminal. AVAX is one of the world’s 20 largest cryptocurrencies by market capitalization.

HIT PIECE On Monday, Roche and Avalanche founder Emin Gün Sirer fired back. In a statement, Sirer called a report accompanying the videos a “scurrilous hit-piece” and said Roche had misrepresented his work for Ava Labs, the company behind Avalanche, in an attempt to “impress a potential business partner.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Infrastructure

😳 Data Giant Shocks Ethereum With Ban on Mining

Hetzner’s Decision Spurs Debate About Decentralization of Crypto Infrastructure

By Owen Fernau

SERVER FARMS Struggles to decentralize have long shaped the development of smart contract and governance layers in the crypto ecosystem. Last week something else struck: Hetzner, the second largest hosting provider for Ethereum, clarified that crypto miners may not use its server farms to support the blockchain network, or any other crypto venture.

MESSAGE “Using our products for any application related to mining, even remotely related, is not permitted,” Hetzner said in a message to its customers. It said both Proof-of-Stake and Proof-of-Work activities are prohibited. “Even if you run just one node, we consider it a violation of our [terms of service].”

POWER The development highlighted the power of a centralized player in blockchain infrastructure. Hetzner, a 25-year-old company based in Gunzenhausen, Germany, is one of the biggest data center operators in Europe. It maintains hundreds of thousands of servers in Germany, Helsinki, and in Virginia in the U.S.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Sponsored Post

🚀 Build your NFT app in hours instead of months

Ever wanted to deploy your own contracts or build NFT products and apps without having to learn the complex Web3 stack?

NFTPort lets you do exactly that with simple-to-use APIs and SDKs built for developers. NFTPort takes care of all the complicated NFT infrastructure so you can build your NFT project in just a few hours instead of months.

The APIs cover everything you need for NFT development:

Mint NFTs at scale and easily integrate them with your existing product

Deploy and monetize your fully owned NFT contracts

Get the highest quality NFT data (metadata, assets, ownership, transactions) from Ethereum, Polygon, and Solana (launching soon)

You can create an endless variety of innovative NFT products by combining these building blocks from NFTPort. Launch NFT collections, build your own NFT marketplaces or analytics tools, add NFT user portfolios to your existing app, etc.

Excited to build your NFT app? Grab your free API key

Web3

👾 Limit Break Raises $200M To Build Web3 Games

DigiDaigaku Floor Price Is Up 70% to 13 ETH

MASSIVE Limit Break, the company behind the DigiDaigaku NFT collection, has raised $200M over two funding rounds, it announced Monday. The funding, led by crypto venture capital firm Paradigm, will be used to build massive multiplayer online (MMO) web 3 videogames.

FOUNDERS “After a decade of pushing ‘Free to Play’ games to their limits, our founders have spent the past year building Limit Break to replace F2P using Web 3. We call this new model ‘Free to Own,’” the company said in a series of tweets announcing the funding.

AIRDROPS “Free to Own (F2O) is built around free mints for Genesis NFTs. These Genesis NFTs lead to other NFTs through airdrops and more, none of which involve gimmicky fundraising tactics.”

👉READ THE FULL STORY IN THE DEFIANT.IO👈

DeFi Lending

🧐 Compound III Launches With Emphasis On Simplicity

New Iteration Introduces Segregated Base Assets

By Owen Fernau

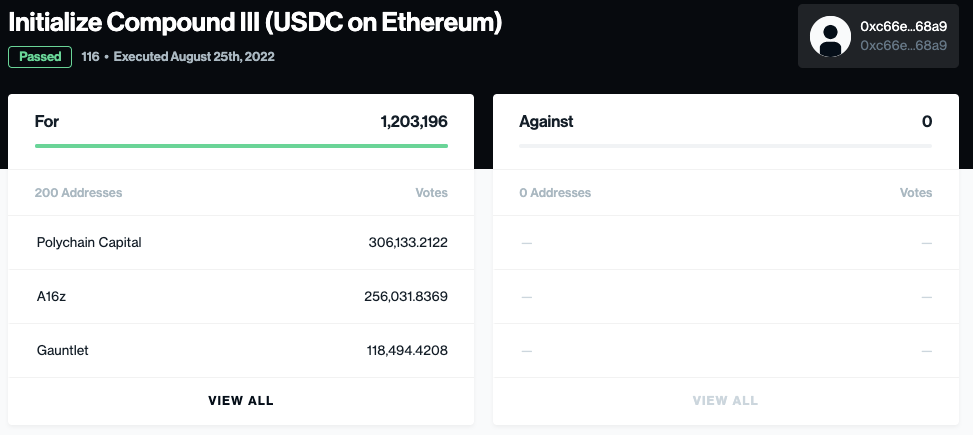

VOTE One of DeFi’s oldest lending protocols has launched a major upgrade. Compound Finance, one of DeFi’s oldest lending protocols with $2.72B in total value locked (TVL), deployed Compound III on Aug. 25 following a successful governance vote.

BASE ASSET The biggest change in the new iteration of Compound is that instead of being able to borrow any asset from a pooled set of assets, users will only be able to borrow one “base asset.”

DEPLOYMENT Compound III will not pay interest on deposited assets, save the base asset. In this initial deployment, USDC will be the base, or borrowable, asset. As of Aug. 26, the USDC deposit yield on Compound III is 2.32%, far higher than the 0.75% offered by Compound V2.

POOLED ASSETS Compound governance will decide on future deployments with different base and pooled assets, according to founder Robert Leshner’s post in the protocol’s Discord.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Market Action

📉 Ether Dives 10% As Powell Signals More Rate Hikes To Come

Majority Of Investors Now Expect A 0.75% Increase In September

TUMBLING Hinting at another sharp interest rate hike in September, Federal Reserve Chairman Jerome Powell sent crypto markets tumbling Friday.

10% Ether has suffered the steepest decline among popular cryptocurrencies, having fallen more than 10% in the preceding 24 hours, according to data from The Defiant Terminal. Solana also dropped 10%, while Bitcoin, Cardano (ADA) and Binance (BNB) each fell 6%.

INFLATION Data from July showed inflation easing somewhat in the United States. The closely-watched consumer price index was unchanged in July, and annual inflation dropped to 8.5% from 9.1% in June, which was a 40-year high. Nevertheless, one month’s good news was not sufficient to proclaim the Fed’s mission accomplished, Powell said during his brief but highly anticipated speech at Wyoming’s annual Jackson Hole symposium on Friday.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

The Tube

📺 Quick Take: Why crypto is getting smashed

DeFi Explainers

🏦 What Is Aave?

A Step-by-Step Guide to the DeFi Lender

FANTASY Just a decade ago, the notion that one could borrow money without banks was in the realm of fantasy. After Bitcoin laid the groundwork for Ethereum and other smart contract platforms, this was no longer the case.

LENDING Fast forward to 2022, and we have Aave, an open-source lending service that anyone can use to become a lender or a borrower. In this Aave guide, you will understand how blockchain lending works, and how Aave has become a leading DeFi platform.

INSPIRED In 2017, Stani Kulechov quit his law degree and founded a venture called ETHLend. The University of Helsinki graduate was inspired by Ethereum to create a peer-to-peer lending and borrowing platform. The next year, Kulechov rebranded ETHLend into Aave, and in January 2020 he launched the platform on the Ethereum mainnet. Since then, Aave has expanded to other blockchain networks, including Avalanche, Fantom, Harmony, Arbitrum, Polygon, and Optimism.

👉READ THE FULL STORY IN THE DEFIANT.IO👈

Elsewhere

🔗 FBI Issues Warning Over Vulnerable DeFi Platforms: Decrypt

The Federal Bureau of Investigation issued a new warning Monday focused on attacks against decentralized finance (DeFi) platforms, saying that cybercriminals are exploiting vulnerabilities in the smart contracts that govern them.

🔗 Graysca Disclosing SEC Queries, Says Cryptos XLM, ZEC, ZEN May be Securities: CoinDesk

Grayscale Investments LLC has been fielding questions from the U.S. Securities and Exchange Commission (SEC) over the firm’s “securities law analysis” of tokens in some of its less-popular crypto trusts.

🔗 The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai: MakerDAO

Financial regulation trends towards a post-9/11 paradigm of “either you’re with us or you’re against us” with eventual zero tolerance for anything that doesn’t give full control and surveillance powers to the state.

Trending in The Defiant

The Merge Won’t Drive Big Scalability Gains For Ethereum, But EIP-4844 Might All eyes may be on Ethereum’s forthcoming transition to Proof-of-Stake consensus, but there is a lesser-known upgrade that’s set to cut Ethereum’s transaction costs, improving scalability – unlike the so-called Merge.

Compound III Launches With Emphasis On Simplicity One of DeFi’s oldest lending protocols has launched a major upgrade. Compound Finance, one of DeFi’s oldest lending protocols with $2.72B in total value locked (TVL), deployed Compound III on Aug. 25 following a successful governance vote.

Stargate’s STG Token Surges Ahead Of FTX Listing Stargate Finance had an eventful start. The cross-chain protocol held an auction for its STG token on Mar. 17, only to have trading firm Alameda Research, buy all 100M of them in the very first block, as confirmed by then-CEO, Sam Trabucco.

🧑💻 ✍️ Stories in The Defiant are written by Owen Fernau, Aleksandar Gilbert, Samuel Haig, and yyctrader, and edited by Edward Robinson, yyctrader and Camila Russo. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

Free subscribers to the newsletter get:

Daily news briefings

Sunday Weekly recap

General chat on The Defiant’s Discord server

👑Prime defiers get:

Full transcript of exclusive podcast interviews

DeFi Alpha weekly newsletter on how to put your money to work in DeFi by yyctrader and DeFi Dad

Weekly live DeFi Alpha call with yyctrader

Inbox Dump edition of The Defiant newsletter every Saturday with all the PR that didn’t make it to our content channels

Exclusive community calls with the team

Subscriber-only chats on The Defiant Discord server

Full access to The Defiant’s content archive

Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

You can start a prime membership for free right now with this link. You’ll get full access for 7 days. It’s 100% risk-free.

Defiant Premier for Paid Subscribers

🤖 Web3 Games Infested by 200,000 Bots: Report

Jigger Research Finds Bots Rife on Binance and Polygon

By Samuel Haig

NEWS Web3 games are teeming with bots, and many games residing on Binance are seriously compromised, according to research released on Aug. 30 by Jigger, a bot detection tool.

Keep reading with a 7-day free trial

Subscribe to WE'VE MOVED TO thedefiant.io to keep reading this post and get 7 days of free access to the full post archives.