🎆 48,000% Returns? Popping the Hood on NFT Mania

Hello Defiers! Here’s what we are covering today,

News

Research

Video

Podcast

🎙Listen to the interview in this week’s podcast episode here:

Links

Cuba Regulates the Use of Virtual Assets for Commercial Transactions: CoinDesk

Cross-chain governance and open-sourcing the Aave UI: Medium

The open economy is taking over the old one. Subscribe to keep up with this revolution. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button below ($15/mo, $150/yr).

🙌 Together with:

Balancer, one of the leading DeFi automated market makers (AMM) for multiple tokens. Dive into their pools at

Kraken, consistently rated the best and most secure cryptocurrency exchange, which can get you from fiat to DeFi

Aave, an open-source and non-custodial liquidity protocol where users can earn interest on deposits and borrow assets.

The DeFi Pulse Index, by Index Coop - DPI is the easiest way to capture the upside of DeFi with the benefit of diversification. Buy DPI today on your favorite DEX.

Layer 1 Rally

❄️ The Uniswap of Avalanche Is Having its Biggest Week Ever

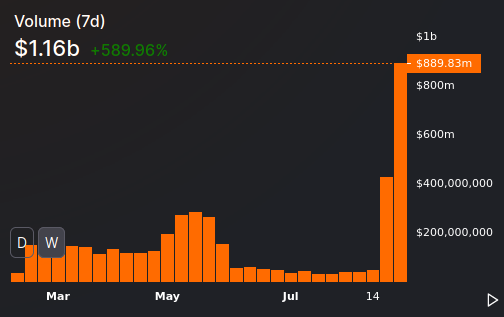

NEWS The decentralized exchange Pangolin, the Uniswap of the Avalanche blockchain, is having its biggest week to date, and the week isn’t over.

DOUBLING According to the exchange’s analytics, it’s closing in on $900 million for the week, already doubling last week’s volume of $425 million, which had also been by far its biggest week.

PANGOLIN From the end of May to mid-August, volumes had been much lower, seldom coming close to $50 million for the week. For many weeks prior to that, however, it had consistently run more than $100 million in weekly volume. Pangolin launched in February.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Layer 2 Options

😋 Lyra Plunges into Layer 2 Options Pool with Offering for Hedge-Hungry Investors

TLDR With the market for Layer 1 tokens such as AVAX red hot this month, it would be easy to overlook a development on the Layer 2 side of the DeFi universe. Yet three days ago Lyra, a cryptocurrency options platform, released a new offering that will let investors trade on Layer 2, a catch-all term for applications that improve the scale and speed of blockchains tied to Ethereum.

SO WHAT Launched on Optimism, a Layer 2 protocol, Lyra uses an automated market maker to help traders buy and sell calls and puts, which are bets that a token will rise or fall in value. Investors often use such instruments in both TradFi and DeFi to hedge the risk of their positions. Lyra’s move will test how well an AMM can handle pricing and liquidity when it comes to options in a Layer 2 environment.

GAS It’s hard to hedge on Ethereum’s Layer 1 because pricing options often costs too much in gas. With action spiking across the cryptocurrency market on the back of a slew of regulatory news and innovations, investors’ appetite for a cost-effective way to protect their flanks may surge in the months to come.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

SPONSORED POST

Molly Wintermute Releases Hegic V8888: 0% Trading Fees and Gas Fee-Free Options Trading

Hegic V8888 is live in mainnet:

https://www.hegic.co/

Hegic is an on-chain peer-to-pool options trading protocol built on Ethereum. With Hegic, DeFi and crypto users can trade 24/7 American, cash-settled, on-chain ETH and WBTC call / put options with no KYC or registration required for trading.

Hegic was founded 1.5 years ago in February, 2020. Hegic V888 (the previous version) was live for 10 months. The results achieved by V888:

● $492,075,000 total volume

● $22M record daily volume

● 6,450 options traded

● 2,825 unique users

● $10,415,000 earned by HEGIC staking lots holders

Introducing Hegic V8888

Trading Options on Hegic V8888

● 0% trading fees: pay only a premium

● 100% gas fee-free options trading

● The lowest prices for ETH and WBTC call / put options

● Auto-exercising of in-the-money options

● Tokenized options for trading on the secondary market

● 90 days is the new maximum period of holding options

Earning Yield on Hegic V8888

● Zero-loss options selling pools with auto-hedging

● x2 higher capital efficiency with flexible collateralization

● Independent pools for selling call and put options

● Individual lock-ups for each liquidity tranche deposited

● Pools’ unrealized profits front-running prevention

● Real-time data on pools APY and P&L per each option sold

Use Hegic now:

https://www.hegic.co/

Research

🎆 48,000% Returns? Popping the Hood on NFT Mania

In this week’s IntoTheBlock column, Lucas Outumuro crunches the numbers on the soaring valuations in the NFT space.

WAVE NFT mania continues to grow, with new drops popping up every day and Ethereum’s gas prices consistently back above triple digits. The recent wave into NFTs was further amplified by Visa’s acquisition of a CryptoPunk and Budweiser’s buy of the beer.eth domain.

IMPRESSIVE Prices of notable NFT collections such as CryptoPunks and Bored Ape Yacht club had already been climbing throughout the past month and accelerated this week amidst the institutional interest coming into the space. This has led to impressive growth in volumes trading at OpenSea and increased demand for the Ethereum blockchain.

PRICE The average price for a CryptoPunk recently reached 67 ETH, representing a 730% increase year-to-date. The even simpler Art Blocks Squiggles have done even better, with their average price up an astonishing 48,000% this year.

DEMAND The success of NFT collections like these has led to a flood of new projects launching their NFTs seemingly every day now. From apes to penguins to koalas, and with several copycats of CryptoPunks, the supply of NFTs appears to be increasing to fill the large surge in demand.

👉READ THE FULL STORY IN THE DEFIANT.IO 👈

Video

📺 Jam Session #5: Ethereum Scaling

Links

🔗 Cuba Regulates the Use of Virtual Assets for Commercial Transactions: CoinDesk

Cuba’s Central Bank issued a resolution establishing rules to regulate the use of virtual assets in commercial transactions and licensing of service providers in that sector.

🔗 Cross-chain governance and open-sourcing the Aave UI: Medium

The Aave Companies are committed to creating open source software that empowers users’ financial, social and cultural independence. For this software, decentralization and — most specifically decentralized governance — will be a core feature; and it is this decentralization that allows community members to contribute to the larger social, cultural and financial ecosystem growing around any software protocol.

🔗 3LAU Launches Blockchain Music Investment Company Backed By Paradigm And Peter Thiel’s Founders Fund: Forbes

Electronic dance music artist and producer Justin Blau, a.k.a 3LAU, stirred the music industry in February when he sold the world’s first-ever tokenized album, which grossed $11.7 million in under 24 hours and briefly held the record for the most expensive single non-fungible token ever sold.

This is a public version of the newsletter and both paid and free subscribers are receiving it.

Free subscribers get:

Daily news briefings

Weekly Recap

Paid subscribers get:

Full transcript of the weekly podcast interview

Early access to opinion columns and research pieces

Exclusive access to Inbox Dump where we send all the press releases that didn’t make it to the newsletter (Saturday)

Exclusive access to subscribers-only Discord chat

Exclusive access to bi-weekly community calls

✊ Head to THEDEFIANT.IO for more DeFi news 📰

🧑💻 ✍️ Stories in this newsletter were written by Brady Dale, Owen Fernau and Lucas Outumuro, and edited by Camila Russo, Bailey Reutzel and Edward Robinson. Videos were produced by Robin Schmidt and Alp Gasimov. Podcast was led by Camila, edited by Alp.

The Defiant is a daily newsletter focusing on decentralized finance, a new financial system that’s being built on top of open blockchains. The space is evolving at breakneck speed and revolutionizing tech and money. Sign up to learn more and keep up on the latest, most interesting developments. Subscribers get full access, while free signups get only part of the content. Click here to pay with DAI (for $100/yr) or sub with fiat by clicking on the button above ($15/mo, $150/yr).